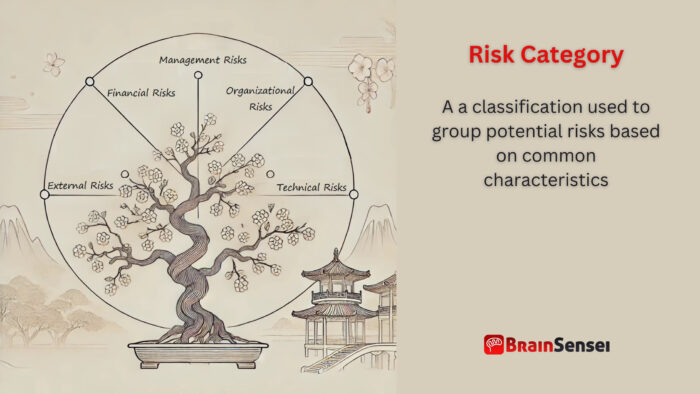

Risk Category

What is the Risk Category?

In project management, a Risk Category groups potential risks based on common characteristics. These categories help project teams systematically identify, assess, and manage risks. By organizing risks into categories, teams can better anticipate challenges and develop targeted mitigation strategies.

Key Takeaways

- Systematic Risk Identification: Organizing risks into categories helps streamline the risk management process.

- Improved Mitigation Strategies: Similar risks often share mitigation tactics, making it easier to plan responses.

- Enhanced Communication: Standardized categories improve communication among stakeholders.

- Resource Allocation: Facilitates better allocation of resources to address the most significant risks.

Understanding Risk Category

How It Works

Risk categories help project managers anticipate and handle potential issues more efficiently. By grouping risks, teams can focus on broader patterns rather than isolated incidents. Risk categories are often defined using a Risk Breakdown Structure (RBS), which systematically organizes risks into a hierarchical framework.

Common Types of Risk Categories

- Technical Risks: Risks related to technology, innovation, and technical processes

- External Risks: Includes environmental, regulatory, and market-related risks

- Organizational Risks: Relates to internal processes, resources, and structure

- Project Management Risks: Stemming from planning, execution, and control activities

- Financial Risks: Encompasses budget overruns, cost estimation errors, and funding issues

Notes

- Proactive Identification: Identify potential risks early to mitigate impact.

- Regular Updates: Risk categories should be revisited and updated throughout the project lifecycle.

- Stakeholder Engagement: Involving stakeholders in risk identification ensures a more comprehensive perspective.

- Consistent Methodology: Use a standardized approach for defining and categorizing risks.

Related Terms

- Risk Breakdown Structure (RBS): A hierarchical representation of risks grouped by categories

- Risk Mitigation: Strategies implemented to reduce or control the impact of identified risks

- Project Risk Management: The overarching process of identifying, analyzing, and responding to project risks

- Operational Risk: Risks arising from internal processes, people, and systems

- Strategic Risk: Risks associated with strategic decisions and business environment changes

Examples of Risk Category

Construction Industry

They categorize risks in a large infrastructure project into technical, financial, and environmental hazards. Technical risks include potential design flaws or equipment failures. Environmental risks could involve delays due to weather conditions, while financial risks focus on material cost fluctuations.

Project managers may identify technical risks, such as soil instability or equipment malfunction when constructing a new bridge. Environmental risks could involve seasonal weather changes or natural disasters that might delay the project timeline. Additionally, financial risks might arise from fluctuating material costs or unexpected labour expenses. By systematically categorizing these risks, the project team can develop specific strategies to address each category, ensuring better risk management and project success.

For example, the team might implement advanced geotechnical analysis to predict soil behaviour when addressing technical risks. The project can mitigate environmental risks by scheduling critical construction tasks during favourable weather conditions. In contrast, they can control financial risks through fixed-price contracts and regular budget reviews. This proactive approach allows the team to minimize disruptions and avoid cost overruns.

Healthcare Industry

A hospital expansion project uses risk categories such as regulatory compliance, patient safety, and financial management. Regulatory risks involve changes in healthcare laws, while patient safety risks consider potential impacts on medical procedures.

Expanding a hospital requires compliance with evolving healthcare regulations, which poses regulatory risks. For instance, new guidelines related to patient care standards might necessitate design changes or procedural adjustments. Patient safety risks involve potential disruptions to medical services during construction, such as equipment relocation or staff training requirements. Financial management risks include budget overruns due to rising construction costs or unexpected expenditures.

To address these risks, project managers often establish multidisciplinary teams to monitor regulatory updates and assess compliance needs. Additionally, regular safety drills help maintain high patient care standards, even during construction activities. They mitigate financial risks through detailed cost estimations, contingency funds, and transparent financial reporting. This structured risk categorization ensures a safe and cost-effective hospital expansion process.

Telecommunications Industry

A telecommunications firm launching a new 5G network categorizes risks into technology, market competition, and operational risks. Technology risks address potential network failures, while operational risks relate to equipment and staff training.

Deploying a 5G network involves significant technological risks, such as software compatibility issues or equipment failures. Market competition risks arise from competitors launching similar services, while operational risks include network infrastructure installation and workforce training challenges.

Telecommunications companies often conduct extensive system testing to mitigate these risks and adopt redundancy protocols to enhance network reliability. They address market competition risks through market analysis, product differentiation, and customer engagement strategies. Operational risks require investments in staff training programs and equipment maintenance routines. By categorizing and proactively managing these risks, telecom firms can ensure a smooth and successful 5G network rollout.

Use Cases of Risk Category

United States ( IT Project Risk Management)

An IT company in California categorizes risks into cybersecurity, compliance, and operational risks when launching a new software product. Early identification of cybersecurity risks helps the team implement stronger protocols, preventing potential data breaches. The company established a dedicated cybersecurity task force to monitor potential threats, conduct penetration tests, and ensure compliance with data privacy regulations. This proactive categorization allowed the company to address potential issues before they could affect the project timeline or integrity.

In addition, the company developed training programs for employees to understand and adhere to compliance requirements. They mitigated operational risks by implementing a robust incident response plan and conducting regular system audits. The project achieved a secure and compliant software launch through effective risk categorization.

Germany (Renewable Energy Project)

A wind farm project in Germany addresses potential challenges using environmental, technical, and financial risk categories. By categorizing ecological risks, the team mitigates delays caused by unpredictable weather patterns. For example, they conducted meteorological studies to predict wind patterns and seasonal weather variations. Technical risks, such as turbine malfunctions or grid integration issues, were managed through regular equipment maintenance schedules and vendor collaborations.

The finance team addressed financial risks by securing long-term funding agreements and conducting detailed cost-benefit analyses. The project also engaged local communities and authorities to navigate regulatory requirements and secure permits efficiently. This systematic approach to risk categorization ensured the successful completion and operation of the wind farm, contributing to Germany’s renewable energy goals.

Singapore (Infrastructure Development)

Singapore’s government-led infrastructure project classifies risks into regulatory, financial, and operational categories. This systematic approach ensures adherence to evolving building regulations and optimized resource allocation. The project managed regulatory risks by continuously engaging with government agencies and establishing a compliance task force.

Adopting transparent budgeting practices and allocating contingency funds for unforeseen expenses mitigated financial risks. Implementing performance tracking systems and diversifying supplier partnerships addressed operational risks, such as contractor performance or supply chain disruptions. The comprehensive risk categorization process facilitated smooth project execution, with infrastructure enhancements delivered on schedule and within budget.

Best Practices for Managing Risk Categories

Proper risk categorization requires a structured and proactive approach. Best practices include:

Develop a Comprehensive Risk Breakdown Structure (RBS)

Establishing an RBS helps systematically organize risks into categories and subcategories. It ensures that no significant risk is overlooked and provides a clear framework for analysis.

Engage Stakeholders at All Levels

Effective risk categorization requires input from diverse stakeholders, including project sponsors, team members, and external partners. Regular risk workshops and brainstorming sessions can uncover hidden risks and enhance collective understanding.

Utilize Risk Management Tools and Software

Leveraging modern risk management tools can streamline the categorization process. Tools like Primavera Risk Analysis, @Risk, and Microsoft Project offer functionalities to track, analyze, and prioritize risks efficiently.

Implement Continuous Monitoring and Review

Risk categories should not remain static. Schedule regular risk reviews to identify new risks, retire outdated ones, and adjust risk strategies based on project progress and external factors.

Document Risk Management Processes

Clear documentation of risk categories, assessment criteria, and mitigation strategies ensures consistency and knowledge transfer across project phases.

Integrate Risk Management into Project Planning

Risk categorization should align with overall project planning efforts. Integrate risk assessments into milestones, phase reviews, and decision-making processes.

Conduct Training and Awareness Programs

Equip team members with the knowledge and skills to identify and categorize risks effectively. Regular training sessions help foster a risk-aware culture.

Use Scenario Analysis and Simulations

Simulating potential risk scenarios helps project teams understand potential impacts and test the effectiveness of mitigation strategies. Monte Carlo simulations, for example, can provide insights into possible outcomes and variability.

Ignoring these best practices can lead to incomplete risk assessments, misallocated resources, and project failure. Proactive and consistent application of these strategies enhances project resilience and success.

Common Mistakes and Issues

One common mistake is overly broad or inconsistent categories, which can obscure specific risks. For example, a construction firm that merges technical and environmental risks might overlook weather-related equipment failures, jeopardizing the project timeline.

Another frequent issue is failing to update risk categories as projects evolve. Project environments are dynamic, with new risks emerging over time. Critical risks may go unnoticed if risk categories are not regularly reviewed and updated. For instance, an IT project might face new cybersecurity threats as technology and attack vectors change.

Miscommunication is another challenge. When different teams use inconsistent risk terminology, misunderstandings can arise, leading to incomplete risk assessments or misaligned mitigation efforts. Establishing a shared risk language and providing regular communication training can help alleviate this problem.

Overreliance on historical data is a subtle but significant mistake. While past experiences provide valuable insights, each project has unique aspects that may introduce new risks. Project managers should combine historical data with scenario analysis and expert judgment to capture a more comprehensive risk landscape.

Finally, ignoring stakeholder input can result in incomplete risk identification. Stakeholders, including clients, team members, and external partners, often possess valuable knowledge about potential risks. Engaging these individuals through workshops and feedback sessions can uncover risks that might otherwise remain hidden.

Frequently Asked Questions (FAQs)

Why are risk categories important in project management?

Risk categories help systematically identify and manage risks, improving decision-making and project success.

How do you create a risk category?

Start by defining key risk areas, then group risks based on their sources or impacts.

What is the difference between a risk category and a risk type?

A risk category groups similar risks, while a risk type describes the nature of the risk (e.g., operational, financial).

Can risk categories change during a project?

The team should review and adjust the risk categories as projects evolve.

How does a Risk Breakdown Structure (RBS) relate to risk categories?

An RBS organizes risks into categories hierarchically, aiding systematic risk management.

Additional Resources

Preparing for a PMI certification?

- Exam Prep Courses: PMP®, CAPM®, and PMI-ACP®

- Exam Simulators: PMP®, CAPM®, PMI-ACP®, PMI-PBA®, PMI-RMP®, PMI-SP®, PgMP®, and PfMP®

- Professional Development Units (PDUs): 15, 30, and 60 PDU Bundles